News

Read the latest news from Wesleyan

-

05 Mar 20241 minA new partnership to improve our service to you

Wesleyan are pleased to have agreed to a 10-year partnership with Diligenta Limited.

-

13 Feb 20244 minGiving back in 2023: How we supported our communities

Read about some of the numerous projects and initiatives Wesleyan Foundation supported in 2023.

wesleyan foundation, -

31 Jan 20242 minWesleyan Foundation unlocks £100,000 of charity funding

Wesleyan Foundation is giving £100k to hardworking charities as part of its second Winter of Giving fund.

wesleyan foundation, -

14 Nov 20233 minWesleyan’s new Equality Grant launches with a £70k donation

Wesleyan has donated grants to eight organisations across the UK dedicated to reducing inequalities in their local communities.

wesleyan foundation, -

08 Nov 20232 minNew Lived Experience Advisory Panel launched

Wesleyan have introduced a Lived Experience Advisory Panel, providing a platform where improvements to community services can be shared.

wesleyan foundation, -

23 Oct 20233 minABI guidance following UK floods

The Association of British Insurers (ABI) has released guidance for those affected by the floods caused by Storm Babet.

-

16 Oct 20232 minWesleyan Foundation’s Climate Action Grant donates £74,000

Wesleyan Foundation's new Climate Action Grant launches with a £74,000 donation to UK projects tackling climate change.

wesleyan foundation, -

16 Oct 20233 minLuton Airport car park fire - insurance update and FAQs

The Association of British Insurers (ABI) has released a statement on the car park fire at Luton airport, along with guidance and FAQs for those affected.

-

28 Sep 20232 minWesleyan donates £65,000 to BMA research project on PPE

Wesleyan Foundation’s £65,000 donation to the BMA will help to evidence the repercussions PPE has on doctors’ and nurses’ health.

wesleyan foundation, doctors, -

20 Aug 20232 minWesleyan donates 500k breakfasts to children across the UK

Wesleyan Foundation has donated over half a million breakfasts for hungry schoolchildren through the Magic Breakfast charity.

wesleyan foundation, -

07 Aug 20231 minWesleyan renews partnership with the RCGP for a fourth year

Wesleyan will continue to provide no-obligation specialist financial advice to suit RCGP members’ personal and business needs.

doctors, -

04 Aug 20232 minWesleyan joins the Association of Financial Mutuals

Wesleyan looks forward to adding its voice to the fantastic work the AFM is doing to raise the profile of mutuality across the UK.

mutuality, -

04 Aug 20233 minWesleyan bolsters board with new appointment

Wesleyan appoints Gary Dixon to its Board of Directors as Chair of the Audit Committee.

appointments, -

06 Jul 20233 minWesleyan Foundation and Small Woods plant 400 trees

Wesleyan Foundation plants four hundred new trees across the UK in partnership with the Small Woods charity.

wesleyan foundation, -

13 Jun 20231 minWesleyan Foundation hits marvellous £5 million milestone

Since its launch five years ago, Wesleyan Foundation has now awarded a total of £5 million to good causes across the UK.

wesleyan foundation, -

02 Jun 20231 minWesleyan donates £10k for Pregnancy to Parenthood Programme

Wesleyan’s donation to CASBA will help further develop their Pregnancy to Parenthood Programme for adults with learning disabilities.

wesleyan foundation, -

22 May 20232 minWesleyan offers specialist financial services to the FMLM

Wesleyan partners with the FMLM to provide medical professionals with specialist financial advice and services, practical guidance and more.

doctors, -

15 May 20233 minNew mental health support groups for dentists

In collaboration with Wesleyan Foundation, Doctors in Distress announce new mental health support groups for dentists.

wesleyan foundation, -

15 May 20232 minNew mental health support groups for IMGs and doctors

Doctors in Distress announce new mental health support groups for International Medical Graduates and doctors.

wesleyan foundation, doctors, -

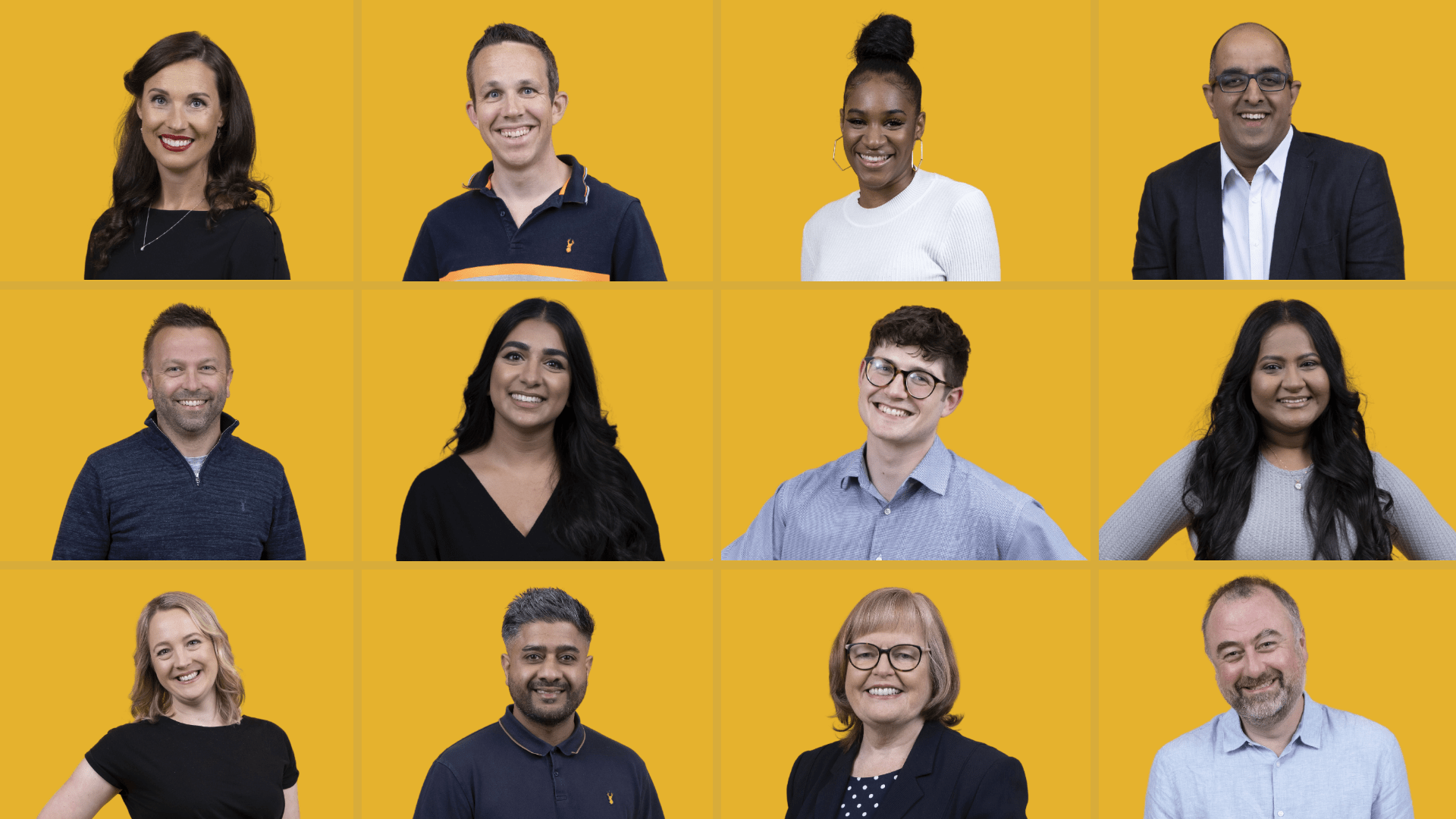

15 May 20231 minInvestments team bags another award

Wesleyan's investments team receives the Diversity Award at the Wealth & Asset Management Awards 2023.

investing, -

28 Feb 20233 minAnnual results - Wesleyan Group shows growth in 2022

Wesleyan has announced its annual results for 2022. Learn about the Group's performance here.

investing, mutuality, -

28 Feb 20231 min'Investment Team of the Year' award win for Wesleyan

Wesleyan's investments team named ‘Investment Team of the Year’ by the Insurance Asset Risk Awards 2023.

investing, -

26 Jan 20233 minWesleyan Foundation unlocks £100,000 for charities

Wesleyan Foundation plans to donate more than £100,000 to hardworking charities as part of its Winter of Giving fund.

wesleyan foundation, -

26 Jan 20232 minWesleyan Foundation donates to Little Chicks Life Lessons

Wesleyan Foundation donates almost £80k, enabling the Little Chicks Life Lessons programme delivery to primary schools.

wesleyan foundation, teaching and education, students, -

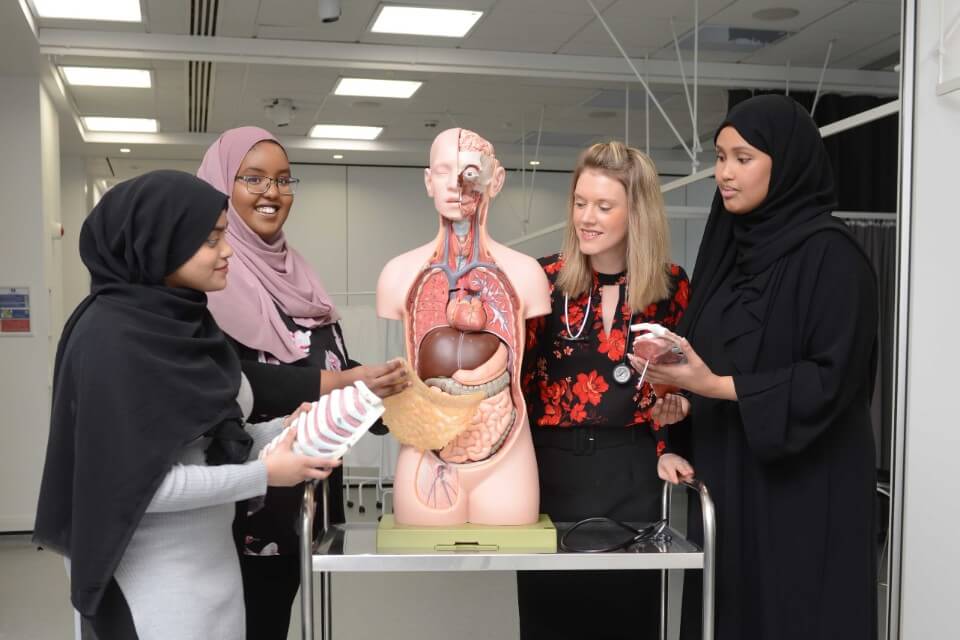

23 Nov 20222 minWesleyan Foundation’s donation to help over 100 students

A £100k donation from Wesleyan Foundation to Aston University will help over 100 young people to pursue careers in medicine and healthcare.

wesleyan foundation, students, -

17 Oct 20222 minWesleyan launches new Employee Value Proposition

Wesleyan launches new Employee Value Proposition with cost of living payment to employees.

mutuality, -

10 Oct 20223 minWesleyan Foundation donates £25k to Doctors in Distress

Wesleyan Foundation’s £25,000 donation will launch weekly support groups for medical professionals.

wesleyan foundation, doctors, -

08 Aug 20222 minWesleyan Foundation’s £35k donation to help young patients

Wesleyan Foundation donates £35,000 to boost the children’s area in a new super hospital being built in the West Midlands.

wesleyan foundation, -

27 Jul 20222 minWesleyan Foundation donates £21,000 to Magic Breakfast

The Magic Breakfast charity is set to provide an additional 150,000 breakfasts this summer with the help of Wesleyan Foundation’s donation.

wesleyan foundation, -

14 Jul 20222 min'The Next Step' programme wins prestigious marketing award

'The Next Step' recently took top spot at the prestigious Financial Services Forum Awards for Marketing Innovation.

students, -

27 Jun 20222 minWesleyan Foundation donates £30,000 to Sport 4 Life

Birmingham-based youth employment and skills charity, Sport 4 Life UK, has received a £30,000 donation from Wesleyan Foundation.

wesleyan foundation, -

15 Jun 20222 minWesleyan appoints three ESG specialists to its team

Dan Gamson, Jazz Sehmi and Jacob Ayre will all play a key role in building Wesleyan’s Environmental, Social and Governance (ESG) practices.

appointments, -

09 Jun 20221 minWesleyan to offer specialist financial services to the RCOG

Members of the Royal College of Obstetricians and Gynaecologists (RCOG) will receive practical guidance on key financial issues.

doctors, -

20 May 20223 minWesleyan Foundation donates £20,000 to Villa Vision

Wesleyan Foundation donates £20,000 to Villa Vision’s child eye health project to help evaluate its impact.

wesleyan foundation, -

17 May 20221 minWesleyan appoints new investment specialist to its Board

Read about the recent appointment of Rita Bajaj to Wesleyan's Board of Directors.

appointments, -

12 Apr 20222 minWesleyan members set to share £36m mutual bonus

See how Wesleyan's 2021 performance has resulted in a £36m mutual bonus for Wesleyan members.

mutuality, investing, -

12 Apr 20223 minWesleyan Group announces strong performance for 2021

Looking to see how Wesleyan performed in 2021? Get the full picture of our strong results.

mutuality, investing, -

07 Mar 20222 minThe crisis in Ukraine - A note to investors

As a responsible mutual, it is important we offer some reassurance to investors as stock markets are likely to remain volatile as a result of current events.

investing, mutuality, -

25 Feb 20222 minInvestments team named ‘Responsible Investor of the Year’

Wesleyan's investments team has been named ‘Responsible Investor of the Year’ by the Insurance Asset Risk Awards 2022.

investing, -

22 Feb 20222 minA statement from our CEO on the sale of Wesleyan Bank

A statement on the sale of Wesleyan Bank to Hampshire Trust Bank (HTB) Group from Wesleyan’s CEO, Mario Mazzocchi.

wesleyan bank, -

11 Jan 20222 min£1m of donations in Wesleyan's 180th birthday year

Wesleyan and its charitable Foundation celebrate making donations of more than £1m to good causes across the UK over the last 12 months.

wesleyan foundation, -

12 Nov 20212 minWesleyan grant to create four sustainable UK Woodlands

Wesleyan has donated £25,000 to Small Woods Association (SWA) to create four sustainable woodlands across the UK.

wesleyan foundation, -

07 Oct 20212 minWesleyan confirms sale of Bank to Hampshire Trust Bank

Wesleyan has reached an agreement to sell Wesleyan Bank to Hampshire Trust Bank plc (HTB) for an undisclosed sum, subject to regulatory approval.

-

22 Jul 20212 minWesleyan renews partnership with Royal College of GPs

Wesleyan Group has renewed its relationship with the Royal College of General Practitioners, to provide exclusive financial advice for members.

doctors, -

01 Jul 20212 minWesleyan and Aston celebrate three years of partnership

Aston University and Wesleyan are celebrating a successful third year of a partnership to help young people from disadvantaged backgrounds.

students, wesleyan foundation, -

16 Feb 20214 minWesleyan pledges £1m support package for critical workers

See how we're helping front-line critical workers with a £1m 'mutual support package'.

wesleyan foundation,