When you invest in Wesleyan's With Profits ISA, you're buying units in our With Profits Fund. The fund aims to provide steady investment growth by spreading money across various asset classes, and by ‘smoothing’ returns to help mitigate market volatility.

The fund also aims to deliver regular and final bonuses - allowing you to take your share of Wesleyan’s business profits.

Bear in mind the value of investments and any income can go down as well as up. You may get back less than you invested.

What does the fund invest in?

About smoothing

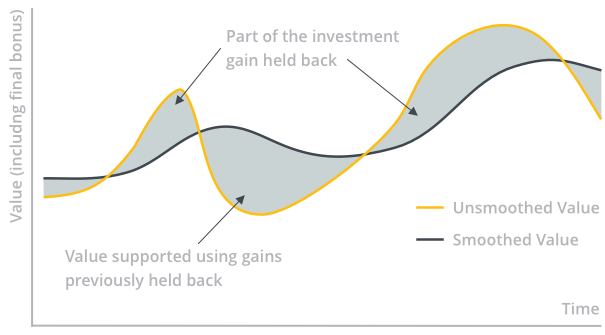

Smoothing is one of the key differences between the With Profits Fund and most other types of investment fund. Simply put, it’s a mechanism to reduce the effect of short-term market fluctuations. It helps you worry less about the ups and downs of investing.

Here’s how smoothing works. When the With Profits Fund is performing particularly well, we don’t pass all the returns to investors straight away. Instead, we hold some back in the fund – ready to apply to your account and cushion any fall in value during times of poorer performance.

Bonuses explained

Regular bonuses

Where possible, we try to add a regular bonus to With Profits plans and policies each year. We can’t guarantee to pay a bonus every year, but when we do, bonuses are guaranteed and can’t be taken away (unless a Market Value Reduction is applied).

The amount of regular bonus we add depends on the annual bonus rate. The bonus rate is reviewed at least once per year and varies depending on the type of product you hold. Below you can see the bonus rates which have recently applied to With Profits ISA customers.

|

|

2023

|

2022

|

2021

|

2020

|

2019

|

2018

|

|---|---|---|---|---|---|---|

|

With Profits Stocks & Shares ISA

|

2.50%

|

2.0%

|

1.5%

|

1.5%

|

1.75%

|

2.25%

|

The annual bonus rates above are effective from 2nd April the following year. For example, 2023 rates came into effect from 2nd April 2024. The bonus rates are gross of annual management charges (AMC).

Final bonuses

The value of Wesleyan’s With Profits Fund depends not just on the performance of our investments, but also on the profits and losses from across our business (including our subsidiary companies).

As a mutual, we don’t have shareholders to pay, so we can pass our profits to our investors instead. This often comes in the form of a final bonus;

Though not guaranteed, a final bonus can enhance the cash-in value of your investment significantly above the regular bonuses that are paid.

Market Value Reduction (MVR)

If you’re investing in the With Profits Fund, you should be aware of what a Market Value Reduction (MVR) is. During periods of extreme stock market volatility, we might need to apply an MVR to protect our investors.

An MVR is an adjustment that can be applied to the value of your investment if you choose to cash-in or withdraw from your policy at certain times, reducing how much you get back. It protects those still invested in the fund when a high volume of withdrawals are made.

MVRs are extremely rare, and at Wesleyan, we haven’t applied one since the UK stock market crash in 2009. We are long-term investors with a track record of only applying an MVR when absolutely necessary.

Information for existing investors

If you are an Intermediary adviser, you will find the information and documents you need on our Intermediaries site.

If you already have a plan or policy invested in the With Profits Fund, you can find a range of details including performance data, charge information and asset allocation by viewing the appropriate fund factsheet. These can be found on the Fund Prices page.

You may also want to read our booklet on ‘How the With Profits Fund Works’. There are three versions of this booklet, depending on what type of policy you hold:

If you are unsure about what type of policy you have with us, please contact your Specialist Financial Adviser from Wesleyan Financial Services, or give us a call on 0800 058 2965. If you have more than one policy with us, you may need to read more than one of the guides.

PPFM documents

All insurance companies issuing With Profits policies are required to establish and maintain their 'Principles and Practices of Financial Management' (PPFM).

These documents provide more details than our short guides on how we manage our With Profits business. There are two versions, one for each of our funds:

Every year, we report to With Profit policyholders on our compliance with PPFM. The latest reports are below: