180 years of Wesleyan...

1841

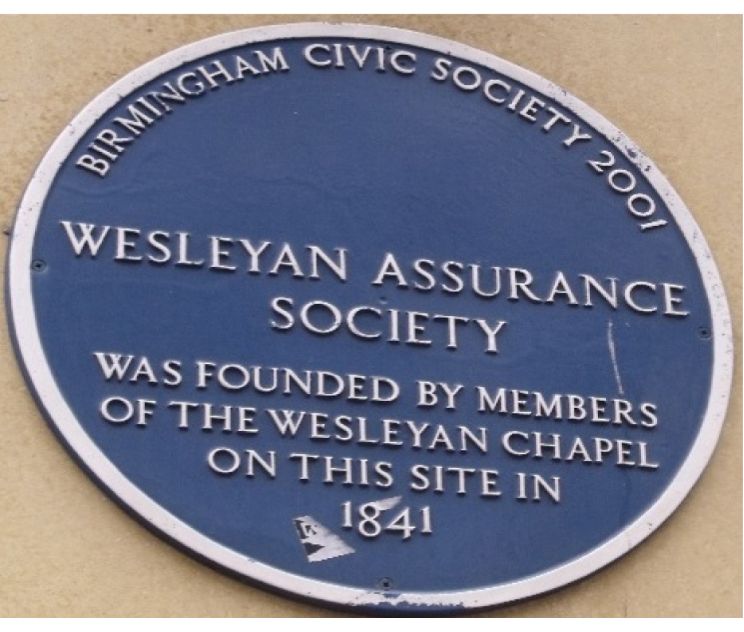

On Friday 23rd April 1841, members of the Wesleyan Methodist Church in Birmingham gathered in a small room next to the chapel on Cherry Street and founded the Wesleyan Provident Assurance Society.

It was the height of the Industrial Revolution and the Society's aim was to help factory workers in Birmingham save for sickness and funeral expenses. The first premium was collected on 27th August 1841. They collected a few pennies every week to help with sickness and funeral expenses, offering life assurance and annuities even back then.

Opening our doors

1855 - Providing life assurance

The Society began offering life assurance on a nationwide scale.

1866 - The Society becomes nationwide

In recognition of the Society's move from being a localised 'provident' to a nationwide organisation, the Society's name changed to The Wesleyan & General Assurance Society (W&G).

The Society became exempt from the restrictions of the Friendly Societies Act, allowing it to grant assurances for unlimited amounts. During this year the Society began to transact industrial life assurance of 'Home Service' - services tailored to the needs of the new manufacturing classes.

Part of this was the creation of a weekly door-to-door collection service. The 'Insurance Man' would become a familiar staple of British life for more than 150 years and was the forerunner to Specialist Financial Advisers from Wesleyan Financial Services, who still meet customers face-to-face today.

1894 - Wesleyan faces challenges

As the Society continued to grow, Birmingham too was growing as a manufacturing, commercial and communications centre. However, Wesleyan was a victim of this success when the London and North West Railway Company required both of the Society's Moor Street premises for the proposed widening of the rail lines into New Street Station.

In recognition of the Society's move from being a localised 'provident' to a nationwide organisation, the Society's name changed to The Wesleyan & General Assurance Society (W&G).

The Society became exempt from the restrictions of the Friendly Societies Act, allowing it to grant assurances for unlimited amounts. During this year the Society began to transact industrial life assurance of 'Home Service' - services tailored to the needs of the new manufacturing classes.

Part of this was the creation of a weekly door-to-door collection service. The 'Insurance Man' would become a familiar staple of British life for more than 150 years and was the forerunner to Specialist Financial Advisers from Wesleyan Financial Services, who still meet customers face-to-face today.

1900

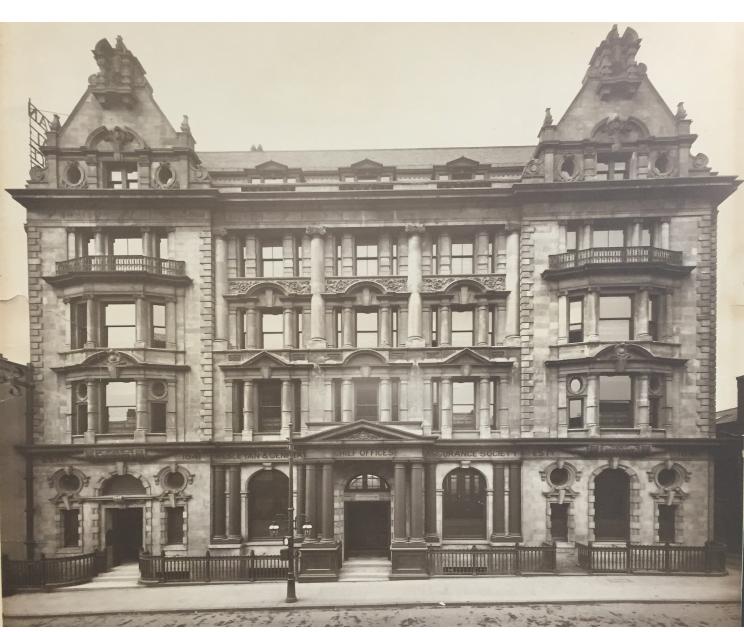

Wesleyan moved into its new state-of-the-art Chief Office on Steelhouse Lane. It would remain in the building for almost 90 years before it was demolished to build the new Head Office.

The early years

1914 - Our efforts during the war

As 'The Great War' began, Wesleyan was a generous subscriber to the Government and Allies' War Loan funds. In February of 1914, a single cheque for £250,000 was drawn for this purpose; the equivalent of more than £26 million today. At the height of the First World War, we looked after our customers by making sure all claims resulting from war injuries were paid - even though we didn't have to.

To celebrate the end of the war, the Government issued Victory Bond policies and the Wesleyan & General bought bonds amounting to £3/4 million.

1923 - Becoming a pioneer

General Manager Arthur Hunt visited the United States. On his return, he introduced a scheme offering Ordinary Branch policyholders the chance of free periodical medical examinations. He also started the unique Wesleyan & General Health Service Bureau. This innovative approach earned the Society a reputation as a pioneer among British insurers.

1929 - A huge financial achievement

The Wall Street Crash leads to the Great Depression, but Wesleyan continued to grow with Annual Premium Income hitting £1 million for the first time.

1931 - Celebrating 100 years of service

A year of celebrations mark the Hunt family's 100 years of combined service to Wesleyan.

1940 - WW2 and Wesleyan

Following the outbreak of the Second World War in the previous year, the Chief Office basement and other buildings owned by the Society were converted into air raid shelters.

First aid HQ was established in the basement toilets. Despite the damage, the company survived and continued to operate throughout the war years.

1944 - Changing the law on tax

The Society single-handedly challenged the taxation of Life Annuities, a situation regarded by many as being unfair. This effort increased awareness of the injustice resulting in the Finance Bill of 1956 changing the law regarding tax on Life Annuities.

1952 - Introducing the Widows and Orphans Fund

The Society introduced the Widows and Orphans Fund. Under this scheme, if an employee died while in the service of the W&G, provision was made for his or her spouse and dependants to receive an allowance from the Society.

1972 - Reaching £100 million

Wesleyan's Assets Under Management hit £100 million for the first time.

As 'The Great War' began, Wesleyan was a generous subscriber to the Government and Allies' War Loan funds. In February of 1914, a single cheque for £250,000 was drawn for this purpose; the equivalent of more than £26 million today. At the height of the First World War, we looked after our customers by making sure all claims resulting from war injuries were paid - even though we didn't have to.

To celebrate the end of the war, the Government issued Victory Bond policies and the Wesleyan & General bought bonds amounting to £3/4 million.

Following the outbreak of the Second World War in the previous year, the Chief Office basement and other buildings owned by the Society were converted into air raid shelters.

First aid HQ was established in the basement toilets. Despite the damage, the company survived and continued to operate throughout the war years.

1991

In the Society's 150th year it moved into its new Head Office building at Colmore Circus, built on the same site its previous offices had been on for almost a century. In the same year, Wesleyan's Assets Under Management hit £1bn for the first time.

The following year, the new building was officially opened by HRH The Duke of Kent KG. The occasion was marked by a VIP gala evening, culminating in a special birthday concert by Sir Simon Rattle and the CBSO at Birmingham's Symphony Hall.

Growing with our customers

1997 - The merge of two societies

Wesleyan Assurance Society merged with Medical Sickness Society, who had been providing financial guidance to doctors and dentists since 1884. This built Wesleyan’s market-leading brand and helped it become the specialist financial services provider it is today.

2003 - A partnership for teachers

A partnership agreement was signed with the National Association of Schoolmasters and Union of Women Teachers (NASUWT) to provide specialist financial services for its membership of over 300,000 teachers throughout the UK.

2005 - Expanding our services

The sales force became multi-tied, offering value and choice to customers through both Wesleyan Assurance Society products and products provided by other suppliers.

2008 - Life Insurer of the Year

Wesleyan Assurance Society was named Life Insurer of the Year at the British Insurance Awards 2008, beating off strong competition from bigger rivals including Legal and General and Scottish Widows.

2009 - A year of awards

Wesleyan received a 10-out-of-10 for overall financial strength in Cazalet Consulting's With Profits ratings for the fifth consecutive year, setting a new precedent in Cazalet rankings. It also won Business of the Year at the regional finals of the National Business Awards and Best Use of IT in Insurance award for its recently introduced point-of-sale system.

2010 - The start of our apprenticeship scheme

Wesleyan Assurance Society was once again named Life Insurer of the Year at the British Insurance Awards 2010. In October, Wesleyan partnered with the National Skills Academy for Financial Services (NSAFS) and Birmingham Metropolitan College to establish a ground-breaking apprenticeship scheme. It was one of the first financial services providers in the country to offer such an opportunity to young people looking to start a career in industry.

2011 - Another year of awards for the business

Chief Executive Craig Errington was named overall Institute of Directors (IoD) Director of the Year, after being named IoD National Director of the Year for Large Businesses.

Wesleyan scooped the Birmingham Post Business Award for Professional Services, Customer Service Team of the Year at the British Excellence in Sales & Marketing Awards and Insurer of the Year at the General Practice Awards.

Chief Executive Craig Errington was named overall Institute of Directors (IoD) Director of the Year, after being named IoD National Director of the Year for Large Businesses.

Wesleyan scooped the Birmingham Post Business Award for Professional Services, Customer Service Team of the Year at the British Excellence in Sales & Marketing Awards and Insurer of the Year at the General Practice Awards.

2013

Wesleyan acquired Practice Plan Group, the leading provider of practice-branded dental membership plans, and Medenta, one of the leading providers of patient finance to UK dental practices. It was a move that would strengthen Wesleyan's position in the dental market.

Building on the success of its apprenticeship scheme, Wesleyan joined forces with Birmingham Metropolitan College to become corporate partners of the Greater Birmingham Professional Services Academy. It aims to develop a pool of skilled young people to work in the region's professional services sector. Wesleyan Bank celebrates 20 years of success.

Securing our financial strength

2014 - 10 out of 10 for financial strength

Wesleyan received a 'ten out of ten' rating from Cazalet Consulting for financial strength in its survey of With Profits providers. Wesleyan became the first and only life office to receive the top rating for ten consecutive years.

Wesleyan’s fundraising partnership with Birmingham Children's Hospital was extended for another two years. More than £250,000 had been raised for the hospital's Cancer Unit appeal. The new challenge was to raise £750,000 towards the construction of Magnolia House, a dedicated building within the hospital that provides palliative care and support in a calm and peaceful environment for children and their families.

2015 - Fundraising continues

Wesleyan's fundraising activity for Birmingham Children's Hospital continued with the publication of a specially commissioned children's book. 'The Unstoppable Maggie McGee' sold more than 5,000 copies in its first three months of sale, helping Wesleyan move towards its target of raising £750,000 for the hospital's Magnolia House appeal.

2016 - Celebrating 175 years

Wesleyan celebrates 175 years with a gala dinner for staff. 'The Unstoppable Maggie McGee' goes on sale in Selfridges, marking the first time a children's book had been put on sale in Birmingham's iconic department store.

2017 - The launch of Wesleyan Foundation

Wesleyan Foundation was launched to make charitable donations to good causes aligned to our professions. By the end of 2019, £2 million had been distributed through more than 440 separate grants to charities, community groups and social enterprises across the UK.

2018 - A new Wesleyan chair

Nathan Moss became Wesleyan Chairman, succeeding Bryan Jackson, who had been in the role since 2010. Over the course of his career, Nathan has held senior executive roles at HSBC, Scottish Widows, Lloyds TSB and Friends Life. Nathan also currently serves as non-executive director at Canada Life Group and Canada Life Platform Ltd, and as chair of Canada Life Home Finance in the UK.

Wesleyan received a 'ten out of ten' rating from Cazalet Consulting for financial strength in its survey of With Profits providers. Wesleyan became the first and only life office to receive the top rating for ten consecutive years.

Wesleyan’s fundraising partnership with Birmingham Children's Hospital was extended for another two years. More than £250,000 had been raised for the hospital's Cancer Unit appeal. The new challenge was to raise £750,000 towards the construction of Magnolia House, a dedicated building within the hospital that provides palliative care and support in a calm and peaceful environment for children and their families.

2019

Mario Mazzocchi succeeds Craig Errington as Wesleyan's Group Chief Executive. Mario joined Wesleyan as Chief Operating Officer in December 2018, moving from Lloyds Banking Group where he was Chief Operating Officer for the Insurance and Wealth division. He spent 15 years at Lloyds working across a number of functions within the Group including Marketing, Sales, Change, Strategy and Operations across retail, corporate banking and insurance.

Looking to the future

2020 - Adapting the way we work

Since 2020, we've shown our resilience once more, as we faced the challenges arising from the Covid-19 pandemic. Though our ways of working have changed, with Specialist Financial Advisers from Wesleyan Financial Services meeting clients via video calls, our commitment to serving our customers remains stronger than ever.

2021 - Our With Profits Fund enters the intermediary market

We opened our With Profits Growth Fund Series A to advisers to add to their clients' portfolios, paving the way for strong long-term relationships with intermediaries.

2022 - A new member reward programme

We invested in a new Member Reward programme to offer annual benefits, including retail vouchers and cashback options.

2023 - The Wesleyan Foundation hits £5 million milestone

In 2023, the Wesleyan Foundation reached a major milestone, with £5 million donated to good causes across the UK since launch.

The Foundation was set-up to support causes that are important to its members, customers and colleagues and the communities in which they live and work.

Since then, it has helped over 550,000 people by awarding grants to charities, community groups and social enterprises across the UK.

In 2023, the Wesleyan Foundation reached a major milestone, with £5 million donated to good causes across the UK since launch.

The Foundation was set-up to support causes that are important to its members, customers and colleagues and the communities in which they live and work.

Since then, it has helped over 550,000 people by awarding grants to charities, community groups and social enterprises across the UK.