- Provides access to a range of asset classes, including property

- Offers smoothed returns to help mitigate the effects of market volatility

- Aims to deliver regular and final bonuses

- Allows you to share in Wesleyan's business profits

On this page

Smoother returns for volatile times

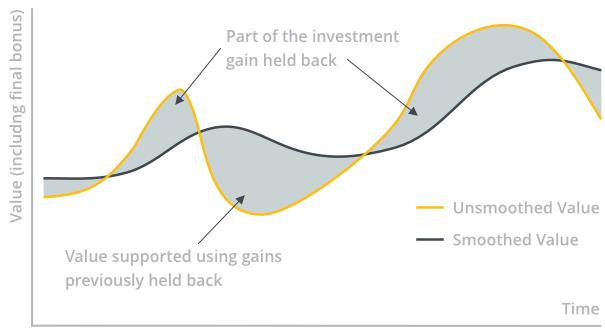

Smoothing is one of the key differences between the With Profits Fund and most other types of investment fund. Simply put, it’s a mechanism to reduce the effect of short-term market fluctuations.

How does it work?

When the With Profits Fund is performing particularly well, we don’t pass all the returns to investors straight away. Instead, we hold some back in the fund – ready to apply to your account and cushion any fall in value during times of poorer performance.

Ultimately, smoothing can help you to worry less about the ups and downs of investing.

Boosting returns with bonuses

The value of Wesleyan’s With Profits Fund depends not just on the performance of our investments, but also on the profits and losses from across our business (including our subsidiary companies).

As a mutual with no shareholders to pay, we can share our financial success with you, through bonuses that may increase the final cash-in value of your investment.

There’s a couple of different bonus types we can issue. Here’s how they work and how they are paid:

Regular bonuses

We try to add a regular bonus to With Profits plans and policies each year. We can’t guarantee this, but we’ve paid a regular bonus every year since 2006.

Regular bonuses are added to your plan value gradually over the course of the year, not all in one go. But once the bonus is added, it is guaranteed and can’t be taken away unless a Market Value Reduction is applied.

The amount of regular bonus we add depends on the annual bonus rate for the type of product you hold. Below you can see our recently applied bonus rates.

Annual bonus rates for unitised With Profits policies

| 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | |

|---|---|---|---|---|---|---|

| Life Fund | 2.75% | 2.25% | 1.75% | 1.25% | 1.25% | 1.25% |

| With Profits Stocks & Shares ISA | 3.00% | 2.50% | 2.0% | 1.5% | 1.5% | 1.75% |

| Pension Fund (series 1) | 3.75% | 3.25% | 2.75% | 2.25% | 2.25% | 2.50% |

| Pension Fund (series 2) | 3.00% | 2.50% | 2.0% | 1.5% | 1.5% | 1.75% |

The annual bonus rates above are effective from 2nd April the following year. For example, 2024 rates came into effect from 2nd April 2025. The bonus rates are gross of annual management charges (AMC).

Final bonuses

As well as any regular bonus you may receive, you may also accrue a final bonus. Though not guaranteed, a final bonus can enhance the cash-in value of your investment significantly when the time comes to cash in.

Your final bonus will usually include any mutual bonus you might have qualified for during your time as a policy holder. Mutual bonuses are paid to members from company profits. In both 2020 and 2022, we paid a mutual bonus of 1%. In 2024 we paid a further 0.25%.

What does the With Profits Fund invest in?

The With Profits Fund aims to provide capital growth over the medium to long-term, investing in a range of asset classes to create a diversified portfolio of investments.

These include:

- UK and international shares

- Property

- Fixed-interest stocks

- Cash

You can see an exact breakdown of the assets held within the fund by downloading the fund factsheets from our Fund Prices page.

And you can find out more about the UK commercial property portfolio, and those responsible for managing it, on our Property Team page.

What is a Market Value Reduction (MVR)?

A Market Value Reduction is an adjustment that may be applied to the value of your investment if you choose to cash-in or withdraw at certain times of extreme stock market volatility. This reduces how much you get back. It protects those still invested in the fund when a high volume of withdrawals are made.

MVRs are extremely rare. Wesleyan hasn't applied one since the UK stock market crash in 2008. We are long-term investors with a track record of only applying an MVR when absolutely necessary.

Ways to invest in the With Profits Fund

The With Profits Fund is available through a range of Wesleyan’s investment products, and a number of our life and pensions plans.

With Profits Stocks and Shares ISA

The ISA that allows you to invest up to £20,000 per tax year in the With Profits Fund - with 'smoothing' to help reduce the ups and downs of investing.

Personal Pension Plan

Invest for retirement through a Personal Pension Plan from Wesleyan and you can choose up to 12 funds from a range including the With Profits Fund.

Capital Investment Bond

An investment plan designed for those willing to invest a minimum of £7,500 over the medium to long term.

Flexible Savings Plan

The Flexible Savings Plan lets you invest in up to 12 funds (including With Profits) through a mix of regular and one-off payments.

Information for investors

If you are an Intermediary adviser, you will find the information and documents you need in our Intermediaries area.

If you already have a plan or policy invested in the With Profits Fund, you can find a range of details including performance data, charge information and asset allocation by viewing the appropriate fund factsheet. These can be found on the Fund Prices page.

You may also want to read our booklet on ‘How the With Profits Fund Works’. There are three versions of this booklet, depending on what type of policy you hold:

For Unitised With Profits policies (PDF, 519KB) For products where premiums are used to buy units. All new policies opened after 2002 will fall into this category.

For Conventional With Profits policies (PDF, 481KB) For products where premiums are not used to buy units. This will only apply to older policies.

Medical Sickness Society (PDF, 2.2MB) For policies purchased from The Medical Sickness Society before our merger in July 1997.

If you are unsure about what type of policy you have with us, please contact your Specialist Financial Adviser from Wesleyan Financial Services, or give us a call on 0800 058 2965. If you have more than one policy with us, you may need to read more than one of the guides.

PPFM documents

All insurance companies issuing With Profits policies are required to establish and maintain their 'Principles and Practices of Financial Management' (PPFM).

These documents provide more details than our short guides on how we manage our With Profits business. There are two versions, one for each of our funds:

Wesleyan PPFM - Open Fund (PDF, 371KB)

Wesleyan PPFM - Medical Sickness Fund (PDF, 268KB)

Summary of Changes (PDF, 116KB)

Every year, we report to With Profit policyholders on our compliance with PPFM. The latest reports are below:

PPFM Compliance Report to Policyholders - Open Fund (PDF, 107KB)

PPFM Compliance Report to Policyholders - Medical Sickness Fund (PDF, 110KB)

Frequently asked questions

The fund is run by Marc O’Sullivan. Marc joined Wesleyan in 2003 as an Investment Analyst and has been a Fund Manager since 2012.

Marc is backed in the running of the fund by an award-winning team of Fund Managers and the Investment Research Team.