Investing in funds

If you’re considering investing into a With Profits Fund, you may not know how they work and what makes them unique to other investment types out there.

When you invest in any fund (including With Profits) you’re investing in what is known as a ‘pooled’ investment. This means your money is added to all other investments made by individual investors in the fund.

Think of the fund as a basket full of investments, with each investor holding their fair share of the basket. A specialist fund manager can then makes all the decisions of when to buy, sell or hold investments within the fund.

This means an investor, such as yourself, doesn’t have the difficult job of trying to manage their own investments.

What are With Profits Funds?

With Profits Funds generally invest in shares (also known as ‘equities’ or ‘stocks’), bonds, property, and cash, and are medium to long-term investments. So, the longer you leave your money invested in the fund, the more potential there is for growth.

If your investment does well, returns are paid to it in the form of bonuses. You may also be entitled to a final bonus when you cash it in.

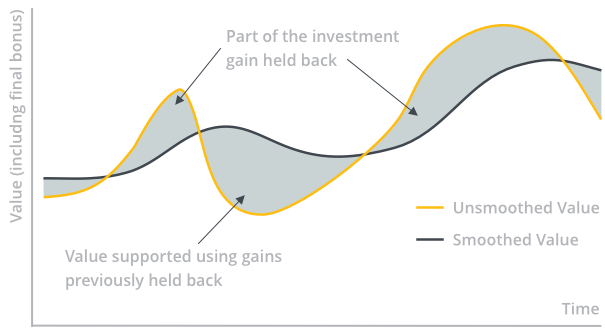

Smoothing out the highs and lows

If the volatility of the stock markets is a concern for you, but you still want to invest, a With Profits Fund could provide a smoother investment journey. This is because of an element unique to With Profits, known as smoothing.

Smoothing aims to reduce the impact of sharp rises and falls in the markets. It works by holding back some fund returns when market performance is strong, to support customer returns when the markets experience losses.

Wesleyan's With Profits Funds

You can invest in our With Profits Funds through a range of products, including our Stocks and Shares ISA and Capital Investment Bond. Here’s why you should consider our With Profits Funds to invest your money.

- Our award-winning in-house investments team do all the hard work for you - investing your money with a long-term view, they use periods of market volatility to find investment opportunities they believe will benefit our customers over the longer term.

- We invest in a range of assets - including shares, property, fixed interest (including government bonds) and cash.

- Mutual status and financial strength - in addition to the returns generated by our Investments Team, investors’ returns can also be boosted through a share of our profits.

The value of your investment, and any income, can go down as well as up and you may get back less money than you invested.

Award-winning investment team

Wesleyan's With Profits Fund is managed by an award-winning investments team. We were named Responsible Investor of the Year at the Insurance Asset Risk Awards 2022 and Investment Team of the Year in 2023.