Our heritage

As a mutual, we’ve been owned by our members for over 180 years, meaning there’s never been any shareholders pushing for short-term gains.

The strongest of values

Wesleyan Group offers a range of funds, with specialist Fund Managers who make the decisions on when to buy, sell or hold the assets within the fund.

Using their knowledge and expertise, our Fund Managers and Analysts actively research the market to identify assets from all classes that they believe will deliver strong customer returns.

By holding good quality assets and monitoring their performance, we aim to try and outperform the market over time. We believe equities (shares in companies) are a good way of achieving this, which is reflected in the makeup of our moderate- and higher-risk funds.

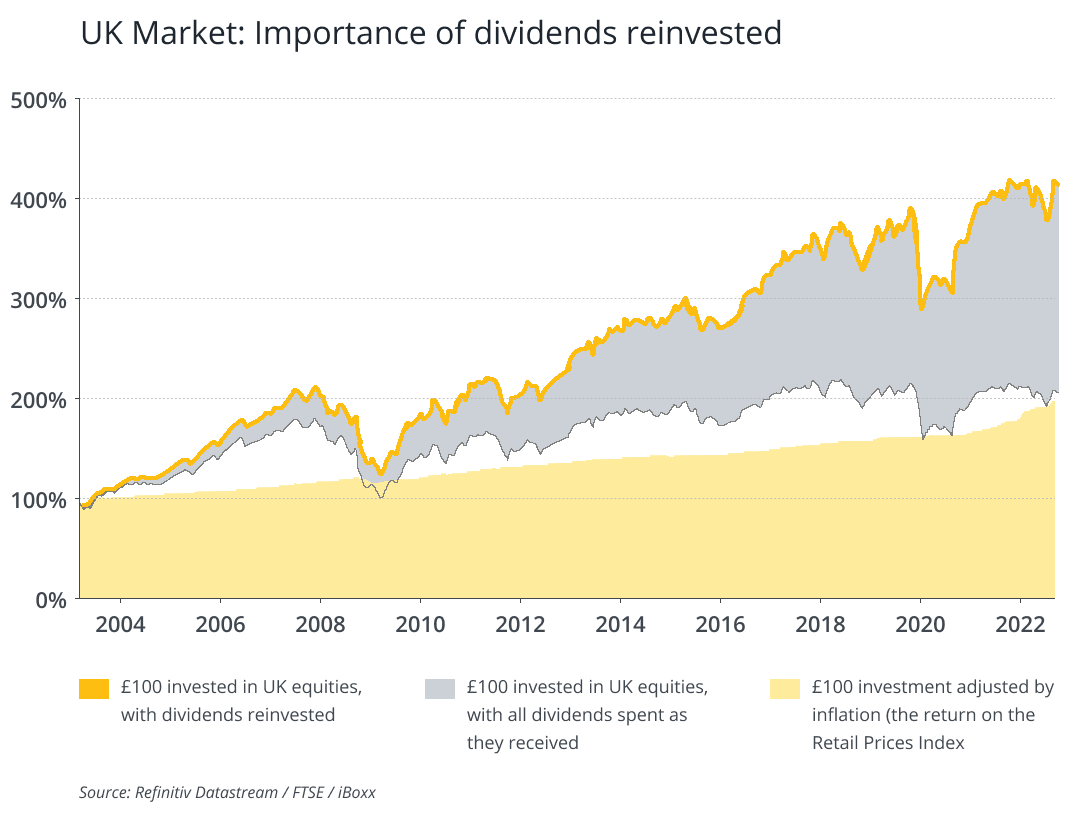

A key part of our approach to investing is to reinvest any dividends paid out on equities. Dividends are a form of income that a company may pay out to shareholders. Through the reinvestment of dividends, further growth can be gained on any initial growth you may receive.

The graph below shows how reinvesting dividends could have an impact on the overall growth of your investment. In this case, the percentage growth of £100 invested in 2003, up to the end of 2022.

Please remember that past performance is not a reliable guide to future performance, and the value of your investment can go down as well as up, so you could get back less money than you invested.

As we have no shareholders, our focus is solely on achieving a better outcome for you and all our members.

Our key strategy of ‘buy and hold’ means investments are intended for the long term (a minimum of five years but typically 10 years or longer). Our Fund Managers look to identify equities that may be out of favour with others but have the potential to grow in value over time. So, when the markets are down, we are more likely to be buying equities than selling them.

The best interest of our members is at the forefront of everything we do, so you can be sure we will always: